VTS acts like a thermostat, balancing liquidity supply with market demand.

How VTS Works

Each currency in a Fiet Market has a VTS ratio, comparing settled liquidity (on-chain funds) to committed VRL. A target VTS sets the desired settlement level, starting at a base rate (e.g., 2% for USDC). As traders demand a currency, the target VTS rises, prompting market makers to settle more funds. When demand falls, excess liquidity can be withdrawn, maintaining efficiency.Key Features

- Dynamic Adjustment: VTS responds to trade volume, increasing settlements during high demand.

- Collateralisation: A base VTS ensures market makers always have some on-chain funds.

- Proportional Obligations: Larger commitments mean higher settlement responsibilities.

- Efficiency: Allows market makers to settle only what’s needed, reducing capital lockup.

VTS adjustments are driven by trades, ensuring real-time alignment with market conditions.

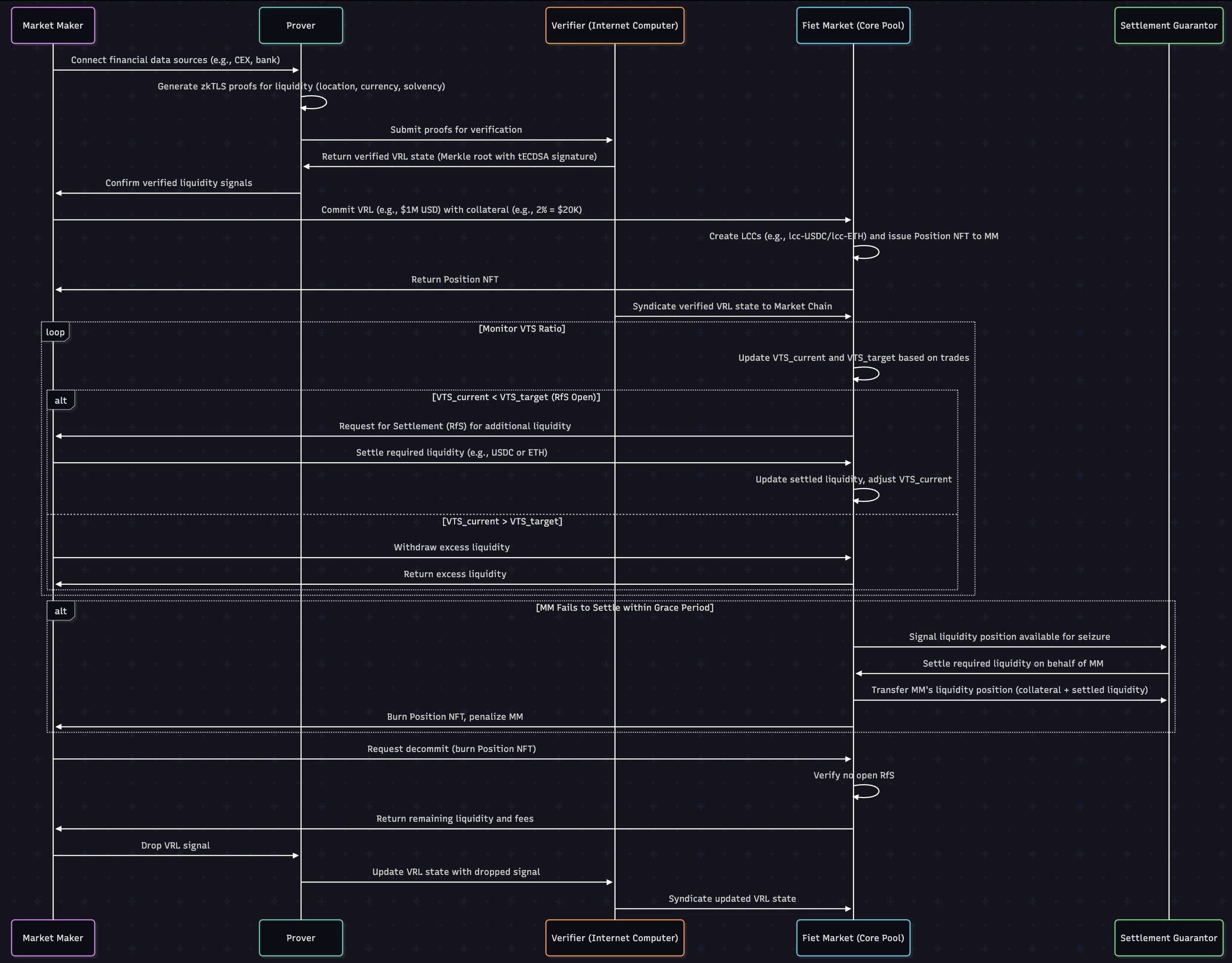

Sequence Diagram

Learn More

Explore related concepts and details:- Liquidity Commitment Certificates: See how VTS governs LCC settlements.

- Settlements: Understand how VTS triggers liquidity delivery.

- Markets: Learn about AMM pools using VTS.

- Technical Specification: Review VTS mechanics.

- Join the Community: Discuss VTS strategies on Discord.